The way you are thinking about stablecoins is wrong (probably)

- Paul Mitchell

- Dec 2, 2025

- 6 min read

Updated: Dec 3, 2025

Money used to be issued and enabled by single entities: your bank creates money by lending against fractional reserves, it controls your experience with it, and facilitates its use. With stablecoins, this whole stack is getting unbundled. The problem is that version 1 of stablecoins had everything bundled together, and so that – and our acquired instinct for how banks work – has shaped how we think about stablecoins. This gives us a set of intuitions about stablecoins and their possibilities that might be wrong.

The Original Model

Tether / USDT and Circle / USDC provide the source of the usual mental model for stablecoins. The stablecoin issuer accepts fiat currency, uses it to buy low risk, interest bearing, high quality liquid assets, and creates a token for you to use in whatever system you like. This big two have evolved since then through acquisitions (Tether) and business model development (Circle), but that basic model is the starting point.

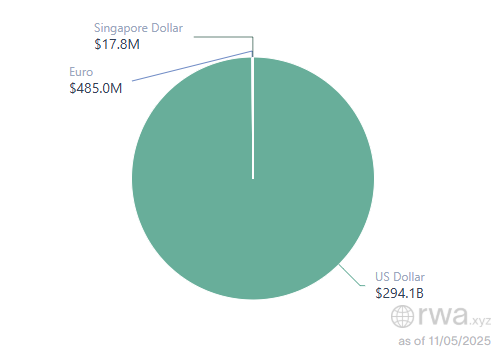

The thing is that this mental model of stablecoins is wrong on two dimensions. The two dimensions are currency and business model. I touched on currency in a previous article. USDC and USDT together make up over 85% of stablecoins in issue, and over 99% by value are US dollar denominated. We are very early, as I pointed out in that article in terms of non US Dollar or Euro stablecoins. Given where we are now, if you are building a stablecoin, you should be taking all the available knowledge into account. Stablecoins that are not Dollar or Euro denominated are all starting from a low base, and so the business model competition is wide open.

Picks & Shovels

My mental framework for the “other” stablecoin model is M0. What they have done is to unbundle the constituent pieces of stablecoin construction. This is fun, because it follows the same pattern as DeFi (decentralised finance), where innovators use crypto tools to unbundle and rebuild financial services on chain: composability. The M0 view seems to be (and I am drawing heavily on this article by Luca Prosperi of M0) that they choose to build the picks & shovels for stablecoins. They have broken down stablecoin issuance and identified the parts that can be commoditised. They can then partner for the rest, and there are specialist companies in lots of the parts of the stack. This pattern is also visible in a different form in acquisitions. TradFi and large fintechs are creating specific capabilities by buying the companies that plug the gaps in what they do.

The example in Prosperi’s article is MetaMask’s stablecoin, mUSD. The infrastructure is provided by M0, but issuance and custody are done by Bridge, and wallet, brand and user experience comes from MetaMask themselves. There are two other pieces: the blockchain it works on, which is Linea on top of Ethereum, and the actual ‘real world’ custodian of collateral assets, not identified. The distribution and brand are linked: customers trust a given brand in a certain jurisdiction or even globally. The issuance and custody part will, I think, be jurisdiction-specific, since it will depend on local stablecoin regulations. The infrastructure and wallet are universal in terms of technology, although wallet issuers may be obliged to do KYC according to local rules.

Stablecoin Unbundling

For each stablecoin, the pieces can be built by a single entity, or assembled in a kind of “Stablecoin as a Service” model. Stripe are doing this: providing stablecoin infrastructure for their customers through Bridge (issuance) and Privy (wallet), and now creating their own blockchain (Tempo). Each piece also works on its own – witness Bridge in the MetaMask model. Banks could do this too: they have brands and customers, can work with partners to build wallets and tokenised deposits, while doing their own ‘custody’ – in this case regulated deposits.

Those who have already got into stablecoins can commoditise what they are doing. Circle are doing a version of this with the xReserve, which makes it easy to issue a USDC backed coin on your blockchain. BlackRock, BNY and others offer funds that are “Genius compliant”, i.e. they adhere to the collateral rules in the Genius Act, providing that piece of the puzzle. There are many other examples, often listed as "partners" in the stablecoin announcements we read.

Benefits of Interest

The discussion above is about the operational pieces of stablecoin issuance. Another aspect that is unbundling is the capital and interest part of the money. Banks issue money and benefit from the net interest margin – the difference between what they pay out on deposits and what they charge for loans. In stablecoins, the equivalent is the interest that accrues to the capital backing the stablecoin. For Tether, this all accrues to the issuer – making Tether multi-billion dollar profits with a staff complement that may still be in double figures. To support distribution, other issuers, like Circle, share their interest revenue. As models commoditise, more of that interest ends up in the pockets of users as the democratisation of finance squeezes value towards the customer.

So the component pieces are:

Custody of collateral assets

Issuance of the stablecoin

The blockchain it lives on, often more than one

The infrastructure components

The wallet

The brand and user experience

The interest is a side effect, and along with any transaction fees, is what funds this whole thing.

In terms of the above, the Circle model is everything except the wallet and user experience. It is designed from a DeFi perspective as a tool for others to use and build on - in whatever way they want, with whatever tools they want. To an extent, USDC is the brand, in that using it provides assurance that the backing is sound and all the pieces can be relied on. I find it interesting that they are now building their own blockchain (Arc) to focus on financial use cases - mixing and matching their own model to meet certain users' needs.

The Implications

One consequence of unbundling always seems to be re-bundling. As technology enables component pieces to be separated, new use cases and customer needs appear, and innovation creates new models around them. As usual, my favourite example is music. We started with albums as a way of buying songs, then they became mp3s, so we could pick and choose. Streaming services then found ways of rebundling – as entire artist catalogues, or as playlists. The core product and the core job to be done is the same: I want to listen to Abba (‘Money, Money, Money’ obviously), but the delivery experience has been reshaped by technology. We should look for new business models built around the democratisation of the ability to issue money, enabled by this composability.

I would also expect to see very large asset managers experimenting to drive money into their stablecoin-compatible funds. This would mean them getting further into other pieces of stablecoin issuance: commoditising their complement. If a large manager makes it easy to issue a stablecoin against their collateral, then their core business grows. Similarly, many stablecoin issuers are providing white label wallets for distributors to integrate, making it easier to work with their stablecoin. You mix & match.

You can’t talk about stablecoins without talking about regulation. Currencies are still local, with the dollar and the Euro being the least ‘neatly’ so. As stablecoins denominated in ZAR, GBP, CHF, CAD, and everything else start to grow (and they absolutely have to, to counter crypto-dollarisation), I would expect those Stablecoin-as-a-Service models to be local as well. They will make use of universal picks & shovels, but find their own way of navigating local regulations. As we move towards a multi stablecoin world, key roles will be played by the businesses who ensure that their stablecoins are compatible. This will support inter-operability and integration, ensuring that over time we don’t know or care whose money we are using – it just works.

Study the past if you would divine the future

I will leave the final say to William Stanley Jevons, writing - incredibly - 150 years ago:

“We are so accustomed to use the one same substance in all the four different ways [i.e. the functions of money], that they tend to become confused together in thought. We come to regard as almost necessary that union of functions which is, at most, a matter of convenience, and may not always be desirable."

He was saying that we must not be constrained in our thinking by the way that things are now. Breaking the functions of money away from a single issuer changes what is possible. With new tools, we can assemble new models that are newly desirable. That is the opportunity.