The second mouse gets the cheese

- Paul Mitchell

- Nov 5, 2025

- 3 min read

Updated: Nov 18, 2025

When my father dropped me off at college, just before he left for the drive home, he said to me “I wish I was where you are now, knowing what I know now”. I am sure it is a sentiment that anyone over a certain age has experienced, but it occurred to me that this is a pattern in everything, not just personal experience.

Take finance. It is obvious now that financial services will be tokenised. Consumers may not see it, or even know it, but the financial products and services that they consume will increasingly be built on blockchain rails, powered by stablecoins and other tokenised assets. Indeed, this is so clear that the CEOs of the world’s largest financial companies – Citi, JP Morgan, BlackRock and others – have repeated it in just the last week or two. Even forward thinking central bankers acknowledge it. But despite the fact of impending tokenisation becoming received wisdom, we are still, as they say, early.

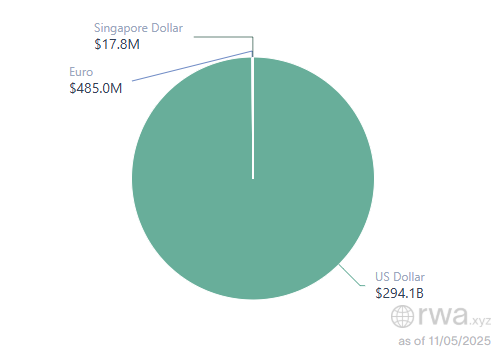

If you look at stablecoins – the most important form of tokenised money – then you can see what I mean. Currently, 99.8% of stablecoins in issue are US dollar denominated. Over 85% are in just two forms: USDC (from Circle) and USDT (Tether). The chart below from rwa.xyz illustrates this.

If you strip out USDC/T then you notice a few things. Firstly, even without these two, the vast majority of the remainder are still USD coins. Secondly, only Euro stablecoins are at any scale amongst other currencies, and Euro stablecoins are over 60% Circle (EURC).

Taking the first point, many of the other USD coins follow a different business model to Circle and Tether. This dominant model at the moment is to issue a stablecoin against a pool of collateral made up of high quality liquid assets, and retain the interest on that collateral. Circle have found that they need to share that interest, most famously with Coinbase, to access distribution. If you look beyond these two big players, then the next layers of USD coins are different (see below): they are crypto collateralised, synthetic dollars, white label models and others. The experiments in business models are happening beneath USDC and USDT because that option is taken.

Taking the second point, across non USD or EUR coins, there are a lot of spikes and troughs that would seem to suggest experimentation; they do not have the rising curves of USD coins. Like the alternative business models hidden by USDC & USDT, this suggests that it is early days for other currencies. See the chart below with US dollar and Euro coins hidden.

This brings me back to the original point: if you could be where you are now, but knowing more. The thing is that you can. While we are currently at the early stages of non USD / Euro coins, we have the accumulated knowledge of a decade of watching those coins and their applications grow. The stablecoins that are currently dominant came out of crypto, and fulfilled a need to hold dollars without leaving the crypto ecosystem. The stablecoins that are being built now are being built in a different world, one where the regulations are much clearer, many models have been tested, lots of options are available, and the future is clearly tokenised for everyone. So if you are building a stablecoin now, there are lots of options to choose from.

If you are in FS and do not yet have a stablecoin strategy then you are behind the game. When you do have a stablecoin strategy, then it can include a lot of information that was not available to the builders at Circle and Tether. Like that young man entering college for the first time, things are about to change. Unlike him, you have access to a lot of information to help you to navigate that change.

(Data and charts from rwa.xyz, 5th Nov 2025)